We decided to move from La Quinta, CA (Coachella Valley near Palm Springs) to Marana, AZ for a lot of good reasons----cooler desert, Tortolita Preserve & open space, fantastic hiking, great golf, University of Arizona sports and lower taxes. Everything has worked out (with a lot of effort!) except for lower taxes. I just assumed that taxes had to be lower in AZ versus CA. Wrong!

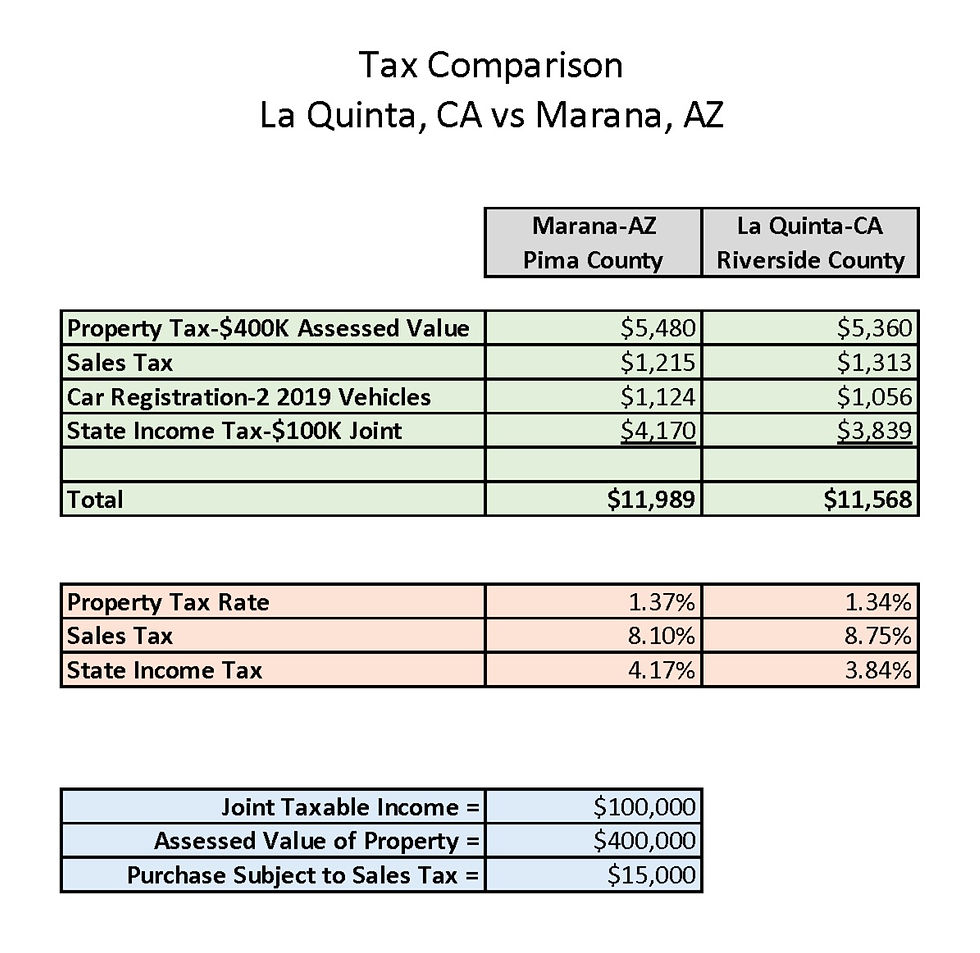

Here is a comparison of property, sales, vehicle and income taxes for La Quinta, CA versus Marana, AZ:

It actually costs a little more (from tax standpoint) to live here! There is no tax bargain for moving from La Quinta, CA to Marana, AZ. In addition, my property taxes in La Quinta came with perks, e.g. garbage pick-up, that you do not get in Marana, AZ.

Let's refresh what we learned in Lease-onomics Part I-Tourism Pays For Preservation.

Marana Sales Tax

Marana obtains about 50% of its revenue from local Sales Taxes and 14% from State Shared Revenues. Marana receives very little revenue from Property Taxes! See Figure to the left showing Revenue By Type taken from 2019 Comprehensive Annual Financial Report (CAFR).

All Sales Tax (Transaction Privilege Tax) receipts are collected by the State of AZ from the vendor and that portion belonging to Marana is subsequently returned to Marana.

Marana Sales Tax rates vary by 20 classifications. The following Exhibit shows three Marana Sales Tax rate examples--Retail Sales Tax, Construction Sales Tax and Hotel Sales Tax.

If you buy a television in Marana, you will be charged 8.1% total Sales Tax of which Marana only gets 2%.

If you construct something in Marana, you will be charged 10.1% total Sales Tax and Marana gets 4%.

If you stay at any hotel (not just Ritz Carlton) in Marana, you will be charged 14.1% total Sales Tax. Here's where the magic begins! There are two Marana Hotel Sales Tax components that total 8%. As shown above, half (4%) goes to the General Fund and half (4%) goes to the Bed Tax Fund. As you'll see next, Bed Tax Fund revenues come from tourists, not local taxpayers, and it pays the freight on the Tortolita Preserve (TP) Lease!

Bed Tax Fund

The Bed Tax Fund is a stand-alone fund utilized to fund tourism which includes the TP Lease rent.

Per ARS §9-500.06((C)(E)), two-thirds (4%) of the Hotel Additional Sales Tax (6%) shall be used exclusively by the Town for the promotion of tourism. The remaining one-third (2%) goes to the General Fund.

The Figure below is taken from CAFR (pg. 112) and shows the revenues, expenditures and fund balance for the Bed Tax Fund. The TP Lease rent of $574,992 is included in the total expenditures of $983,534. The other expenditures were for tourism-related expenses including a Marketing Manger!

Note the year-end fund balance is $1,869,207 and grew by $449,079 in 2019.

The Bed Tax Fund revenues budgeted for 2020 are $1,227,600 which seems light as a new large hotel (Hampton Inn) will be adding more Hotel Sales Tax in 2020.

Summary

Total taxes in Marana, AZ are actually higher than La Quinta, CA

Marana collects a Construction Sales Tax totaling 4%

Marana collects two Hotel Sales Taxes totaling 8%

Half of the Hotel Sales Tax (4%) goes to the Bed Tax Fund

Bed Tax Fund funds tourism including the TP Lease rent